Senior Freeze (Property Tax Reimbursement)

The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence (main home). To qualify, you must meet all the eligibility requirements for each year from the base year through the application year.

The deadline for 2022 applications is October 31, 2023.

2022 Senior Freeze Applications

The NJ Division of Taxation will begin mailing 2022 Senior Freeze blue booklets in mid-February, continuing throughout the month. Please allow until mid-March for delivery before contacting the state.

PTR-1 booklets will be mailed to homeowners who may qualify and preprinted PTR-2 booklets to eligible homeowners who applied last year.

In addition, PTR-1 and some PTR-2 forms are available online at https://www.njportal.com/taxation/ptr

For Additional Information:

- Visit: nj.gov/taxation, select Property Tax Relief and then Senior Freeze Program

- Call the Senior Freeze Hotline: 1 (800) 882-6597

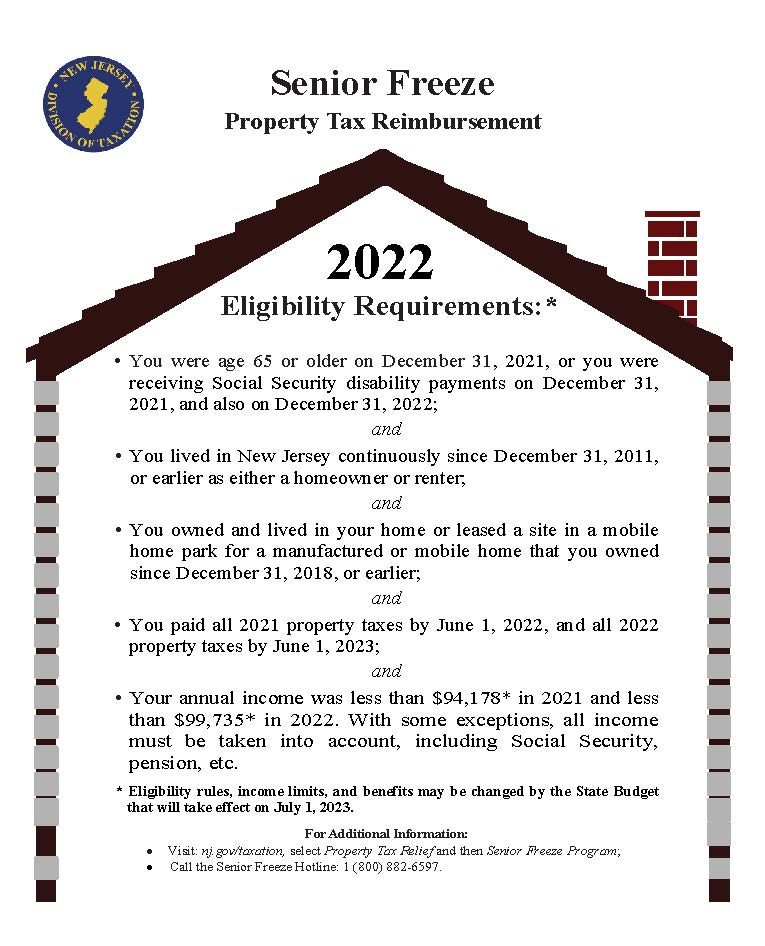

Eligibility Requirements

|

Age/Disability

|

You (or your spouse/civil union partner) were:

- 65 or older on December 31, 2021; or

- Actually receiving federal Social Security disability benefit payments (not benefit payments received on behalf of someone else) on or before December 31, 2021.

|

| Residency |

You lived in New Jersey continuously since December 31, 2011, or earlier, as either a homeowner or a renter. |

| Home Ownership |

Homeowners. You owned and lived in your home since December 31, 2018, or earlier (and you still owned and lived in that home on December 31, 2022).

Mobile Home Owners. You leased a site in a mobile home park where you placed a manufactured or mobile home that you owned since December 31, 2018, or earlier (and still lived in that home/leased the site on December 31, 2022).

If you moved from one New Jersey property to another and received a reimbursement for your previous residence for the last full year you lived there, you may qualify for an exception to re-applying to the Senior Freeze Program. |

| Property Taxes/ Site Fees |

Homeowners. The 2021 property taxes due on your home must have been paid by June 1, 2022, and the 2022 property taxes must be paid by June 1, 2023.

Mobile Home Owners. Your site fees must have been paid by December 31 of each year respectively.

|

| Income Limit |

Your total annual income (combined if you were married or in a civil union and lived in the same home) was:

2021 – $94,178 or less; and

2022 – $99,735 or less

See Income Limits History or past years’ income limit amounts.

|

FAQs

Check your status

Calculation and payment schedule

File a paper application

File online